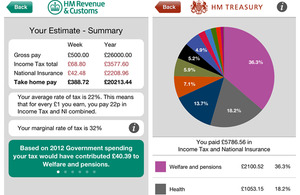

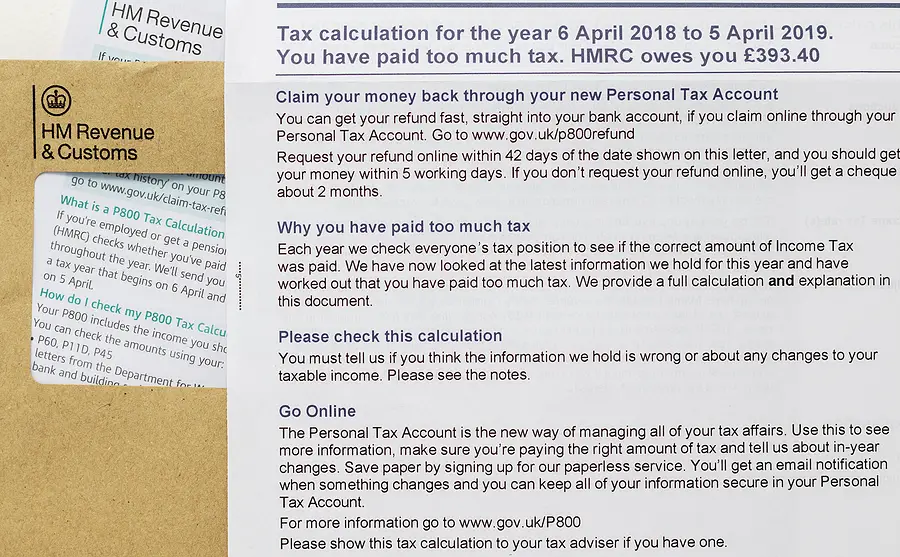

HM Revenue & Customs on Twitter: "If you or your partner claim Child Benefit and either of you have an income of more than 50,000 a year, you can use the child

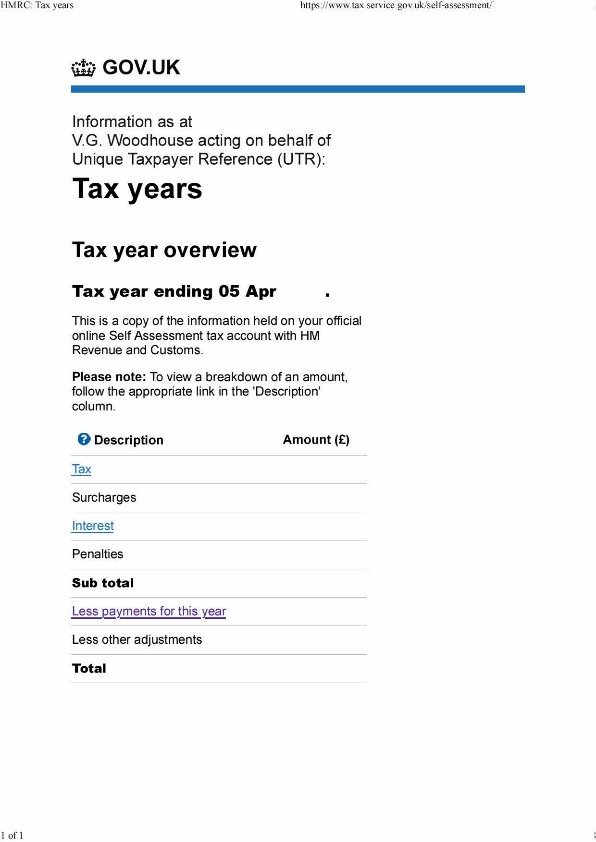

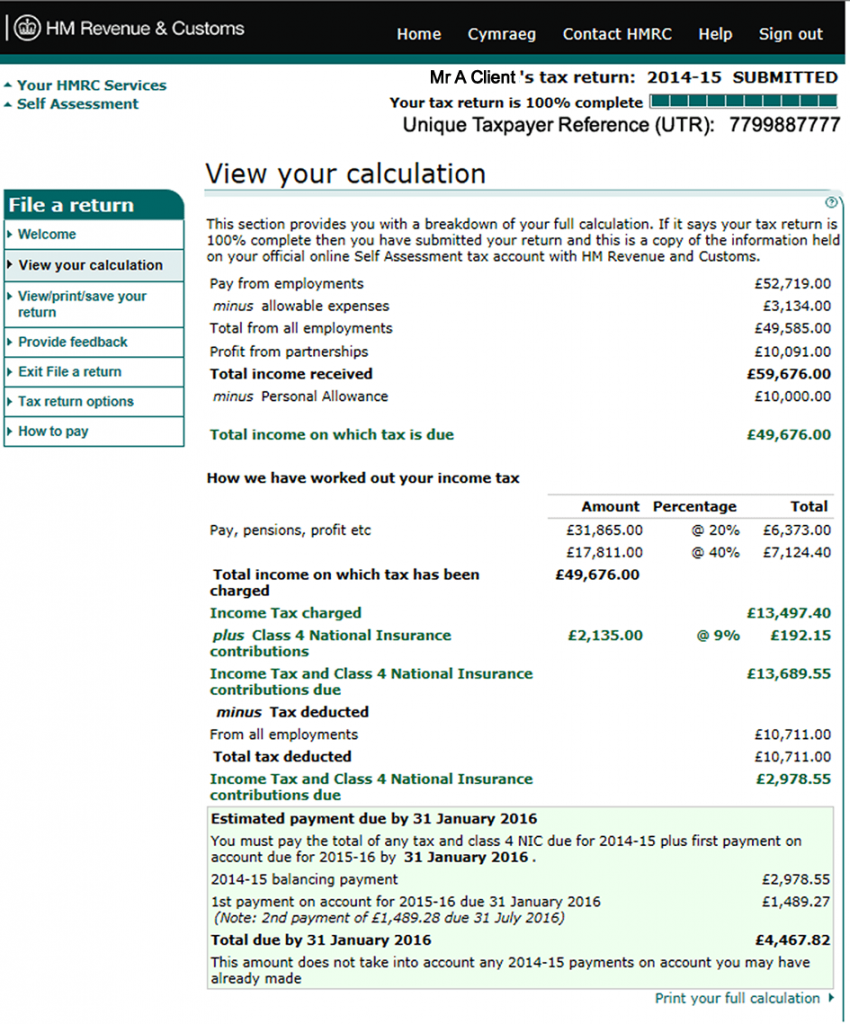

HMRC - Today is the deadline to register for Self Assessment. If you haven't done it before, have an adjusted net income over £50,000 and you or your partner get Child Benefit,