An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

A PRICING TECHNIQUE TO CALCULATE THE SOLVENCY CAPITAL REQUIREMENT FOR NON-LIFE PREMIUM RISK TRONCONI ANDREA Torino, 4 Dicembre ppt download

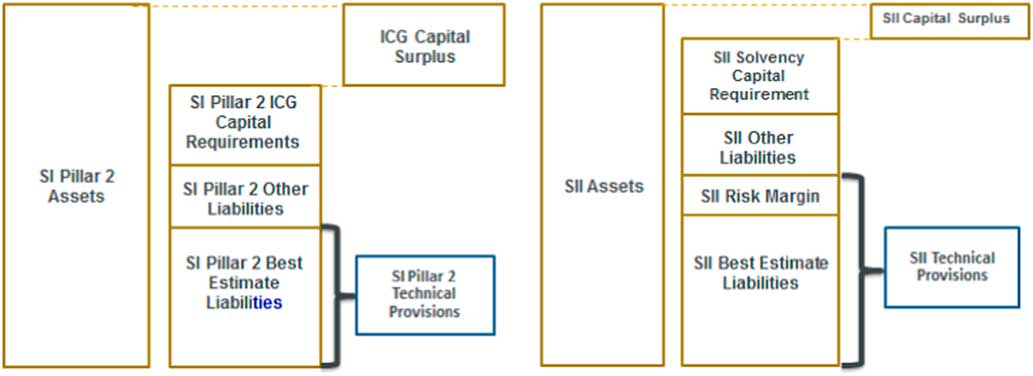

Recalculation of the Solvency II transitional measures on technical provisions | British Actuarial Journal | Cambridge Core

Pragmatic Solutions for Solvency Capital Requirements at Life Insurance Companies: The Case of Spain | Semantic Scholar

Article 178 Spread risk on securitisation positions: calculation of the capital requirement | Regulation 2015/35/EU - Solvency II Delegated Regulation | Better Regulation